In the context of international business activities, professionals deal daily with diverse corporate regulations, each marked by specific features that significantly affect the life of companies. Corporate law, in fact, is a strategic factor: it determines a country’s ability to attract investment, foster entrepreneurship, and ensure a competitive global environment.

A solid and modern legal framework not only meets regulatory needs but also constitutes an essential condition for long-term business stability and sustainability. Investors, in particular, must be able to rely on clear, flexible rules aligned with international standards, providing the certainty required to consolidate and expand their projects.

A legislative reform offering greater flexibility and better adapting to the needs of individual businesses had long been awaited.

Over the past decades, the Principality of Monaco has progressively established itself as an international hub, attracting families and businesses from various countries. These are, for the most part, experienced investors with high expectations.

With the adoption of Law No. 1.573 of 8 April 2025, which introduces substantial amendments to corporate law, the legislator has concretely addressed these needs. This reform marks a decisive step toward modernizing Monaco’s legal framework, enhancing its ability to attract foreign capital, and further consolidating the Principality’s role as a leading international business hub.

Trends in Companies in Monaco

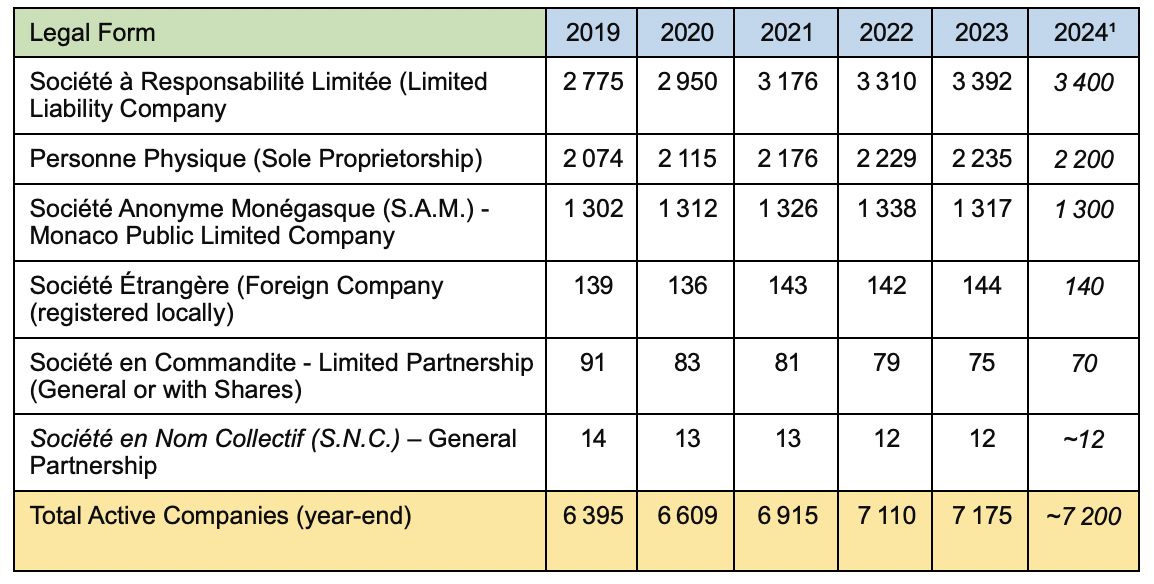

In recent years, the entrepreneurial fabric of the Principality of Monaco has shown steady growth and a gradual diversification of the legal structures chosen by economic operators. An analysis of the data published by IMSEE (Institut Monégasque de la Statistique et des Études Économiques), drawn from the Répertoire du Commerce et de l’Industrie and the official publication Monaco en Chiffres (2025 edition), highlights the evolution in the number of active companies between 2019 and 2024.

Note: ¹Data for 2024 taken from the 2025 edition of Monaco en Chiffres (published in 2025); estimated values where no direct textual confirmation was available in the online documents at the time of consultation.

The data confirm a growing and sustained commercial demand, driven by a preference for corporate structures that ensure a balance between managerial simplicity and legal robustness.

This evolution highlights the Principality’s ability to adapt to the needs of economic operators, strengthening its position as an international hub for companies and investors.

Corporate Law under Law No. 1.573

The law has introduced substantial amendments, with particular relevance for Société Anonyme Monégasque (S.A.M.) and Société à Responsabilité Limitée (S.a.r.l.).

The key points of the reform are outlined below.

Legal Personality

Article 1672-5 of the Civil Code, as amended by the new legislation, provides that:

- for commercial and civil companies, legal personality is acquired upon registration with the Trade and Industry Register;

- previously, legal personality was acquired at the time of signing the articles of association for société civile and upon obtaining government authorization for commercial companies.

The reform therefore addresses a significant practical issue: company formation could often be halted before registration, exposing shareholders to uncertain liabilities and potential legal disputes. Under the new provision, shareholders benefit from clearer and stronger protection.

Articles of Association of the S.A.M.: Greater Flexibility

Another significant innovation concerns the incorporation of the Société Anonyme Monégasque. It is no longer mandatory to rely exclusively on a notarial deed:

- the parties may now choose between a notarial deed and a private deed, with the assistance of their lawyers or advisors. This change reduces formalities and makes the incorporation process faster and more flexible.

Publication Requirements

The reform also amends the regime governing publication formalities:

- failure to publish no longer results in the nullity of the company, but rather in its unenforceability against third parties.

Requirements for S.A.M. Directors

In the past, directors of a S.A.M. were required to hold at least one share in the company in order to qualify for the position. However, this rule proved distortive: directors participated in shareholders’ meetings with voting rights, potentially influencing corporate decisions and, in some cases, even exercising a de facto minority veto.

The new law removes this requirement, restoring full decision-making autonomy to shareholders and reinforcing the separation between management functions and shareholders’ meeting functions.

Shareholders’ Meetings and Board Meetings via Videoconference

One of the most impactful innovations concerns the possibility for both the board of directors and the shareholders’ meeting to be held by videoconference.

- During the COVID-19 pandemic, this option had been introduced as an exceptional measure through government decisions and was later allowed by means of statutory amendments.

- The new legislation now makes this option permanently regulated, providing legal certainty.

- A Sovereign Ordinance will set out the practical provisions for implementing this measure.

6. Non-Voting Shares

The law introduces the possibility for certain shares of a S.A.M. to carry no voting rights.

- This provision enables greater diversification of the shareholder base, allowing a distinction between “active” shareholders (involved in governance) and “passive” ones.

- For example, it may be used to allocate shares to employees as a form of incentive, without affecting decision-making balances.

- The measure draws inspiration from established practices in the Anglo-Saxon legal framework, where differentiation of share classes based on voting powers is widely recognized.

This innovation translates into a more modern and flexible corporate governance model, capable of responding to diverse operational needs.

Minority Shareholders’ Rights

Another significant element concerns the strengthening of minority shareholders’ prerogatives:

- shareholders holding at least 10% of the share capital gain the right to propose the inclusion of new items on the agenda of shareholders’ meetings;

- they are also entitled to submit written requests to the Chairman of the Board up to twice a year.

Before the reform, minority shareholders lacked formal tools to exercise such informational or participatory rights, even though the board was required to act in good faith.

Directors and Boards of Directors

The reform expands the limits on the number of directorships that can be held concurrently:

- directors of a S.A.M. may now sit on up to 12 boards of directors simultaneously (compared with the previous limit of 8);

- for the Chief Executive Officer, however, the maximum limit remains more restrictive, capped at 8 boards.

Limited Liability Companies (S.a.r.l.)

The possibility of establishing a Société à Responsabilité Limitée with a single shareholder has been introduced.

- This model, already widespread in many foreign jurisdictions, enhances the flexibility of S.a.r.l.s, making them more accessible and suitable even for individual entrepreneurial projects.

Conclusion

Law No. 1.573 undoubtedly marks a turning point for corporate law in the Principality of Monaco.

The new provisions make the regulatory framework more modern and competitive, bringing it closer to European standards and providing businesses with more flexible tools to grow and consolidate.

Nonetheless, certain areas remain to be further developed, particularly mergers and acquisitions, which may be addressed in future legislative initiatives.

In this dynamic environment, we as professionals have the responsibility to support change, strengthening our expertise and putting it at the service of a sophisticated clientele that recognizes the Principality as an ideal environment to develop their projects.